Within the intricate global economic landscape of 2023, a series of unique events is unfolding. Among these, it is noteworthy that the United States’ unemployment rate has reached its lowest level since 1968, and core inflation stands higher than the peak in 1983.

Additionally, the Federal Reserve and the European Central Bank have raised interest rates at an unprecedented pace in decades. Positive signals from the job market lead experts to believe that the U.S. can contain inflation without resorting to massive layoffs. The resilience and moderate pace of labor market recovery also bolster hopes that the FED can curb inflation without pushing millions of Americans into unemployment and causing an economic recession.

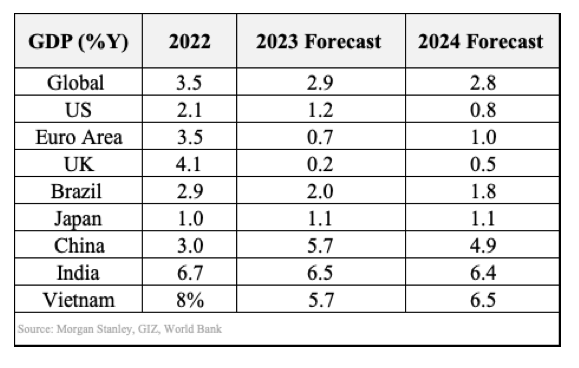

Amidst measures to control inflation, both the United States and Europe have the potential to avoid a recession. In this context, economists predict that the global GDP growth rate will gently decline to 2.9% in 2023, slightly lower than the 3.5% experienced in 2022, and maintain this stable growth into 2024.

The GDP growth forecasts of 2023 and 2024:

Economists believe that the US economy will undergo a soft transition this year, dependent on the extent to which tight credit conditions for households and businesses affect economic activities. It is predicted that there might be a deceleration in job creation, pushing the US unemployment rate to around 4% by the end of 2023 and approximately 4.4% by the end of 2024, with an annual GDP growth of 1.2% in 2023 and 0.8% in 2024.

In the Eurozone, inflation has shown a declining trend after reaching a peak of 10.6% year-on-year in October 2022. Price adjustments in energy, commodities, and food have played an important role in this trend. European economy expert Jens Eisenschmidt anticipates general inflation to stabilize at 5.4% in 2023 and 2.3% in 2024. Despite facing reduced exports and investments, promising GDP growth is expected, reaching 0.7% in 2023 and 1% in 2024.

Bright Spots with Several Positive Aspects, Emerging Markets, Particularly in Asia

Notably, China’s recovery, with its GDP growth potentially doubling to 5.7% in 2023, contributes to the region’s cyclical strength. In India, the medium-term prospects are boosted by trends like digitalization, propelling their economy to a substantial growth rate of 6.5% this year.

For Japan, while the projected GDP growth rates of 1.1% for both 2023 and 2024 might not seem initially impressive, they hold significant meaning for Japan. This outlook signifies robust nominal growth after a prolonged period of relative stagnation.

This transformation signifies a period of change for Japan, where simultaneous growth in employee compensation and business profits is anticipated. The significant increase in income taxes, coupled with positive asset effects, has created a notable impact. Chief Japan Economist, Takeshi Yamaguchi emphasizes continued strength in personal consumption and business spending, acknowledging that while exports might feel the slowdown from the upcoming global economic recession, a relatively weak yen is forecasted to support export business revenues.

Vietnam’s Economy in the Second Half of 2023 and Industry Trends

Economists recognize that Vietnam’s GDP growth rate in the first half of the year has slowed down, but strong domestic demand remains the driving force behind economic growth in 2023.

Contrary to expectations at the beginning of the year, as of August 10, 2023, the World Bank forecasts Vietnam’s economic growth to reach 4.7% in 2023. Subsequently, the growth momentum is expected to recover to 5.5% in 2024. However, the forecasts from the German Development Cooperation Organization (GIZ) are more positive, that Vietnam’s GDP growth could be higher at 5.7% or even as high as 6.5% in 2023, maintaining stable growth in 2024.

The reasons for this slowdown are weakening external demand, as exports in the first half of 2023 declined by 12% compared to the same period. Additionally, domestic demand in the first half has cooled down after the post-Covid-19 recovery period. Although foreign direct investment (FDI) remains steady and public investment slightly increases, overall investment growth has decreased due to weak domestic private investment.

Furthermore, monetary policy tightening in large-scale developed economies to counter prolonged inflation could widen the interest rate differential between the domestic and international markets, putting pressure on the domestic currency exchange rate.

The labor market still faces pressures, with the estimated unemployment rate within the working age group reaching 2.56% in the first six months of 2023, a 0.06 percentage point increase compared to the same period. Notably, service contract employment has also risen in the first half of 2023.

Positive signs and optimism lie in the influx of new FDI capital into the manufacturing sector in 2023, reflecting foreign investors’ confidence in Vietnam’s long-term potential remaining intact. Based on this, economic experts believe that in the latter half of 2023, Vietnam’s exports could slightly increase as the global electronics industry cycle recovers. Vietnam’s domestic services and tourism sectors might continue to experience healthy growth, complementing the economy.

Market Research and analysis by PeopleWise Vietnam

Source:

https://vneconomy.vn/wb-du-bao-nam-2023-no-cong-viet-nam-o-muc-36-gdp.htm

https://thoibaotaichinhvietnam.vn/ba-kich-ban-cho-tang-truong-kinh-te-viet-nam-nam-2023-130520.html

PeopleWise Vietnam was founded with the mission of making positive impact on our community by improving the quality of labor, addressing workforce dynamics, and enhancing its effectiveness. During the initial phase of business, PeopleWise provided human resources consulting services, that align with each organization’s values and vision, driving business success.