The semiconductor chip shortage crisis in recent years has “paralyzed” production lines in several countries. In this context, the semiconductor industry in Southeast Asia has emerged as a solution, and Vietnam is expected to become a focal point in the global semiconductor value chain. However, this industry also presents significant opportunities and challenges in terms of human resources and supply chains.

- From the Global Semiconductor Chip Crisis…

The semiconductor industry is booming, with many companies in this field from Asia to America and Europe achieving tremendous accomplishments. A massive influx of capital is pouring into the semiconductor ecosystem, from mineral exploration, selection and processing to research and development and chip production, estimated to reach nearly tens of trillions of USD. The semiconductor industry has demonstrated its significance since the 1980s. Today, many nations consider it a strategic sector, readily investing heavily to gain a competitive edge.

Semiconductors are materials with moderate electrical conductivity. They act as insulators at low temperatures and become conductive at room temperature, making them suitable for controlling electrical currents. Semiconductors are key to several crucial technologies like 5G, artificial intelligence (AI), autonomous vehicles, and the Internet of Things (IoT), which hold strategic value in defense and security.

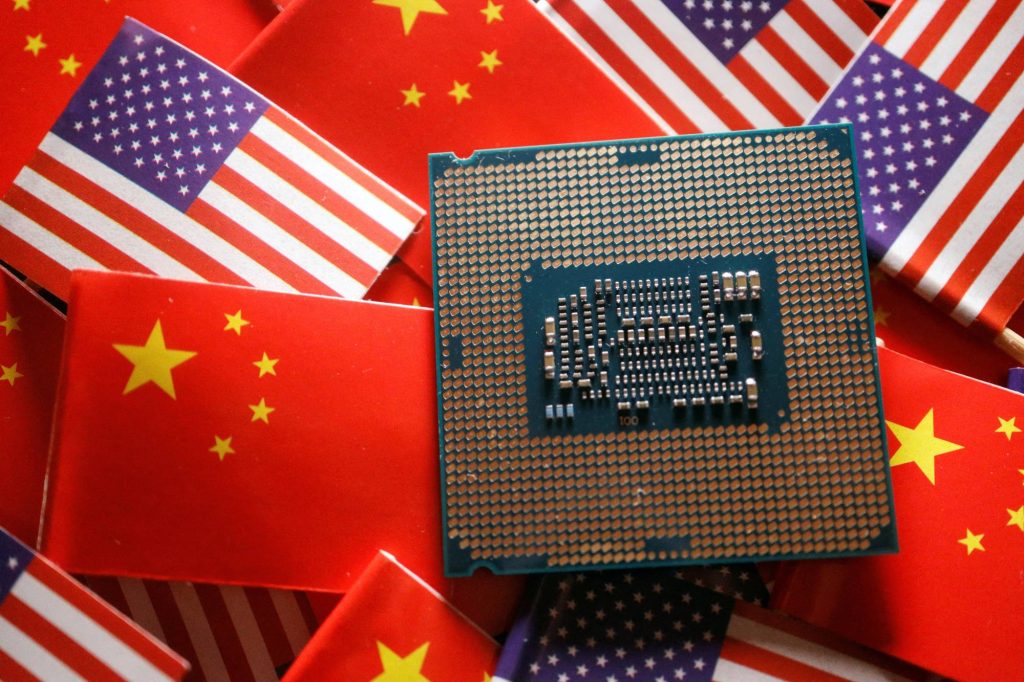

However, concerns about national security, the COVID-19 pandemic, the US-China trade war, and the conflict in Ukraine have contributed to significant disruptions in the semiconductor supply chain. While consumer demand soared, the chip industry faced difficulties in producing and shipping its products. The semiconductor shortage spread globally, and its impact is still felt today. To address the risk of recurring supply chain disruptions, countries and semiconductor corporations are implementing various response measures. One of the most critical solutions is the diversification of semiconductor production, thereby minimizing or eliminating many supply chain issues.

To ensure supply and reduce dependence on foreign countries, nations like the US, South Korea, Europe and China are adapting rapidly by developing their own manufacturing facilities. Furthermore, tensions between the US and the West with China have led semiconductor companies to increasingly promote the “China Plus One” strategy, shifting part of their production to countries outside of China. This aims to reduce dependence and risk associated with the world’s second-largest economy. India and Southeast Asian countries, including Vietnam, are considered potential destinations that semiconductor companies are targeting.

- …to a “Once-in-a-Millennium” Opportunity for Vietnam to Join the Global Semiconductor Industry Value Chain.

Located in the heart of Southeast Asia, Vietnam holds a strategic position in the global supply chain and is an ideal location for manufacturers seeking to enter the region’s rapidly growing semiconductor market. Vietnam boasts a young, abundant workforce with a strong foundation in mathematical thinking and a continuously growing pool of highly skilled personnel. The field of engineering and technology, especially information technology, automation, electronics, and computer engineering, is attracting increasing interest from the younger generation.

Moreover, Vietnam currently ranks second globally in rare earth reserves, a strategic raw material for semiconductor production, only behind China. This is one of Vietnam’s significant advantages in the new trend of the global semiconductor industry. With these strengths, Vietnam has the potential to become a major growth center for the semiconductor industry, as the global chip market is projected to reach 1,4 trillion USD by 2029.

Furthermore, Vietnam enjoys economic and political stability. The government’s policies consistently ensure the interests of investors and workers. According to TTWTO VCCI, to attract foreign investment in the semiconductor sector, the Vietnamese government has implemented an incentive program that is considered attractive and relatively comprehensive. Vietnam offers a preferential corporate income tax rate of 10% for 15 years, applicable to investments in both research and infrastructure development for high-tech sectors, with semiconductors being a priority industry. In addition, the government allows companies and research organizations to build research facilities exempt from property tax (land rent) throughout the lease term if the facility is used for research and startup incubation.

With these strengths and the ability to quickly grasp global changes, the Vietnamese semiconductor industry is facing numerous opportunities. For example, Samsung is investing in the largest product development center in Southeast Asia in Hanoi. Several semiconductor companies from the Netherlands have also started investing in Vietnam. The Dutch company BE Semiconductor Industries N.V. has received an investment certificate for the Saigon Hi-Tech Park, with initial capital of over 115 billion VND (equivalent to 4,9 million USD), to lease a factory and start production. This project is expected to be operational in the first quarter of 2025.

It can be said that the opportunities Vietnam currently has to participate in the global semiconductor industry value chain are likened to a “once-in-a-millennium” opportunity. According to global estimates, over 1 million personnel will be needed by 2030 across all stages of chip design, production, assembly, packaging and testing. With an abundant labor supply and a skilled workforce, human resources are Vietnam’s greatest and most prominent advantage compared to other countries and economies worldwide.

- Human Resources: The Key Factor in Developing the Semiconductor Industry

As the “lifeblood” of the digital economy, the semiconductor industry plays a pivotal role. It is projected that in the coming years, the global semiconductor market will experience double-digit growth, reaching 1 trillion USD by 2030. Alongside the industry’s development, the demand for semiconductor labor remains high. According to data analytics firm McKinsey, from 2018 to 2022, the number of job postings for semiconductor engineering positions skyrocketed at a rate of over 75%. However, paradoxically, there is a shortage of semiconductor personnel globally, even in developed nations and major technology corporations.

Recently, the Semiconductor Industry Association (SIA) predicted that the semiconductor workforce would need to add nearly 115.000 people, reaching approximately 460.000 by 2030, representing a 33% growth rate. However, with the current level of training, the US can only fill 42% of the new demand. In Japan, the race to build semiconductor factories across the country also requires more skilled labor. The number of jobs for semiconductor engineers in Japan has increased 13-fold in the past 10 years. Despite efforts to ensure a ready workforce, Japan’s semiconductor industry association predicts a shortage of around 1.000 highly qualified personnel annually over the next decade.

In South Korea, home to chip manufacturer Samsung Electronics, the chip industry has faced a shortage since 2022 and is projected to experience a labor shortage of 56.000 people by 2031. Demographic trends also impact the semiconductor workforce. Both Taiwan (China) and South Korea, where TSMC (Taiwan Semiconductor Manufacturing Company) and Samsung employ most of their workers, are facing population decline. University enrollment has decreased annually since 2012. These two nations account for over 80% of global contract chip production. The worker shortage has also delayed the construction of TSMC’s Arizona factory.

- Opportunities for Vietnam’s Semiconductor Industry: Human Resources as a Breakthrough Solution

The world is facing a shortage of semiconductor personnel. This shortage is global but mainly in the short and medium term. Vietnam can respond quickly to the global semiconductor workforce demand in the short, medium and long term. According to experts, solving the human resource issue in this field will enhance Vietnam’s position in the global supply chain, attracting major technology corporations to invest in research, development and production in Vietnam.

To seize this opportunity, the semiconductor workforce is considered a key factor. The Ministry of Planning and Investment has drafted a project titled “Development of Human Resources for the Semiconductor Industry to 2030, with a Vision to 2045.” Accordingly, by 2030, Vietnam aims to train 50.000 engineers for the industry across all stages of the value chain. Vietnamese engineers will be able to participate deeply in the design process, packaging, and testing of semiconductor chips, mastering some packaging and testing technologies. By 2045, Vietnam will become a crucial link in the global semiconductor industry value chain, with a team of engineers and experts capable of meeting the development requirements of the Vietnamese semiconductor industry in both quality and quantity.

With the determination to participate deeply in the global semiconductor chain, many Vietnamese enterprises have been investing resources in the semiconductor industry. According to statistics from the Ministry of Education and Training, Vietnam currently has about 35 universities directly training or closely related to semiconductor technology. Among them, Hanoi University of Science and Technology, Vietnam National University, Hanoi, and Vietnam National University, Ho Chi Minh City, are the leading institutions in training bachelors and engineers for the semiconductor chip field. Universities are actively improving training quality and expanding enrollment to meet the future labor demands of the semiconductor industry. This reflects the agility in adapting to the rapid changes in the labor market.

Furthermore, to train human resources to meet international skill standards, Vietnam has strengthened cooperation with global technology companies such as Synopsys, Intel and Cadence. In June 2024, Phenikaa University collaborated with Synopsys to organize the “Train the Trainers” course on semiconductor chip design for university lecturers, engineers and students. In March, Synopsys also signed a cooperation agreement with Vietnam National University, Ho Chi Minh City, to develop human resources in the field of chip design. Intel has also committed to supporting the Da Nang Semiconductor and Artificial Intelligence Center for Research and Training (DSAC) in organizing teacher training courses in the field of artificial intelligence. Recently, the South Korean President also announced support for Vietnam in training human resources in the semiconductor and high-tech industries.

Along with meeting domestic human resource needs, Vietnam is also a destination for personnel recruitment for many countries seeking semiconductor industry workers. Simultaneously, numerous universities and training institutions in Vietnam have opened specialized semiconductor training programs or launched conversion courses for related fields to specialize in this area. FPT University is recruiting 1.000 students for the Semiconductor Chip Design program and is considering offering scholarships of up to 100% of the program tuition for all candidates applying for this major. Hanoi University of Science and Technology, the two National Universities, Da Nang University, Can Tho University, Phenikaa University, Hanoi University of Science and Technology, etc., have also opened new majors and implemented policies to attract students.

Discussing the long-term direction for human resources in the semiconductor industry, a representative of FPT Corporation said: “Job opportunities are clearly visible from Vietnam, the US, Japan, South Korea, etc. The significant issue is the need to improve training quality to meet the stringent requirements of businesses. From there, Vietnamese personnel can work for Vietnamese enterprises like FPT or foreign companies in Vietnam. You can even seize opportunities to work in Japan, South Korea, the US, and other countries.”

- Conclusion

It is estimated that the world will need to increase its workforce by over 1 million personnel by 2030 across all stages of chip design, production, assembly, packaging and testing. With an abundant labor supply and a skilled workforce, it can be affirmed that human resources are Vietnam’s greatest and most prominent advantage compared to other countries and economies worldwide. Therefore, focusing on investment, training, and retraining for the workforce to enter the labor market as soon as possible is a strategic direction and a decisive factor in leveraging investment cooperation opportunities, accessing and transferring technology, and promoting rapid and sustainable economic development based on science, technology and innovation.

Head of Market Intelligence, PeopleWise Vietnam.

As a Ph.D. Student, Research in Economics, Tuyen Le provides market insights, industry trends, and research on labor and workforce effectiveness. Through her research and analysis, she helps business leaders identify potential risks and threats to their businesses and industries, allowing them to take preemptive measures and invest with calculated risks and outcomes.